More About Offshore Trust Services

Wiki Article

Get This Report on Offshore Trust Services

Table of ContentsWhat Does Offshore Trust Services Do?The smart Trick of Offshore Trust Services That Nobody is DiscussingThe Single Strategy To Use For Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is DiscussingUnknown Facts About Offshore Trust ServicesSome Known Factual Statements About Offshore Trust Services The Buzz on Offshore Trust ServicesThe 45-Second Trick For Offshore Trust Services

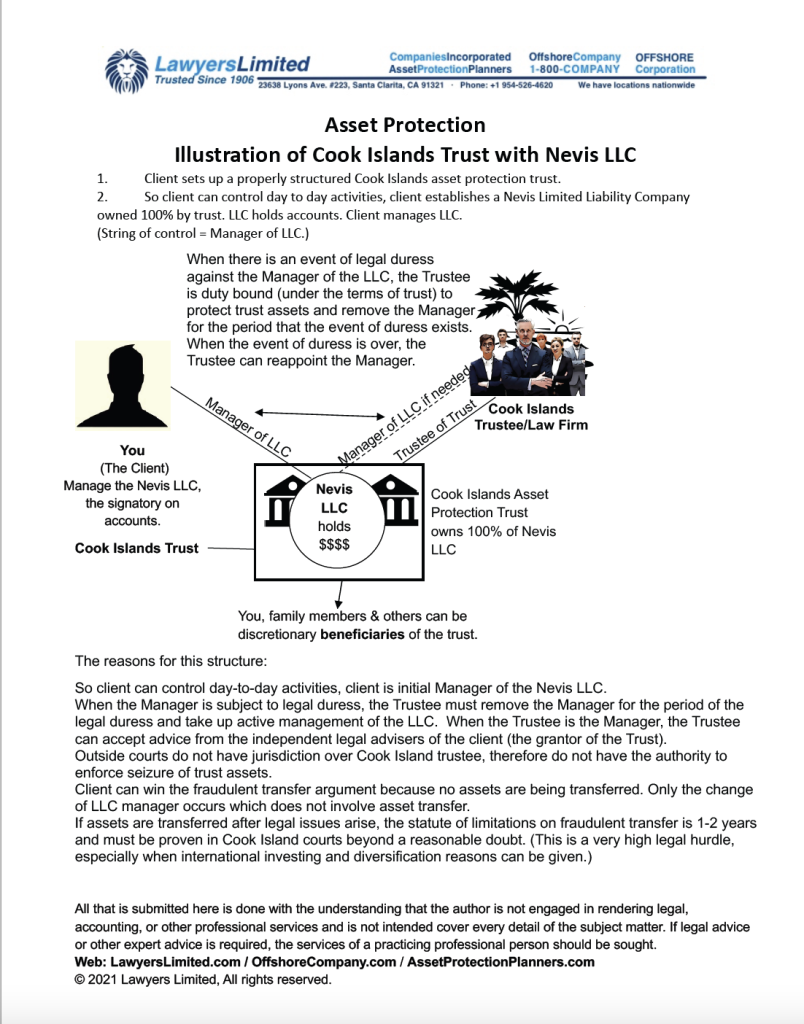

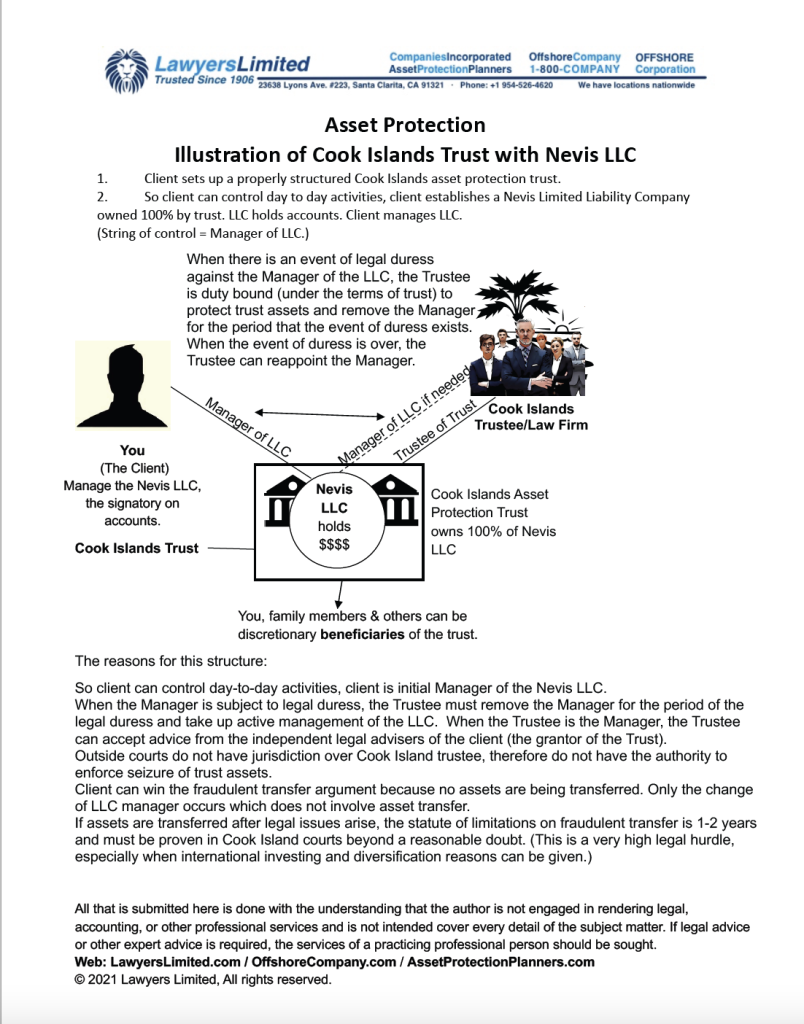

Exclusive creditors, even larger exclusive firms, are a lot more amendable to work out collections versus debtors with difficult as well as reliable asset defense plans. There is no asset security strategy that can deter a highly motivated creditor with unrestricted money and perseverance, however a well-designed offshore trust fund typically provides the debtor a positive settlement.Offshore trust funds are not for everybody. For some individuals facing tough financial institution troubles, the overseas depend on is the finest alternative to secure a significant amount of possessions.

Borrowers might have much more success with an offshore trust strategy in state court than in a personal bankruptcy court. Judgment financial institutions in state court lawsuits might be intimidated by offshore asset security depends on and also might not look for collection of properties in the hands of an offshore trustee. State courts do not have jurisdiction over overseas trustees, which means that state courts have actually restricted remedies to order compliance with court orders.

Offshore Trust Services - An Overview

A bankruptcy borrower must give up all their possessions and lawful passions in home any place held to the bankruptcy trustee. An U.S. insolvency judge might compel the bankruptcy borrower to do whatever is required to transform over to the bankruptcy trustee all the borrower's assets throughout the globe, including the debtor's helpful rate of interest in an overseas depend on.Offshore asset security counts on are much less effective against IRS collection, criminal restitution judgments, as well as household support obligations. 4. Even if an U.S. court does not have territory over overseas depend on possessions, the U.S. court still has individual jurisdiction over the trustmaker. The courts might attempt to oblige a trustmaker to dissolve a trust fund or bring back trust fund possessions.

The trustmaker needs to want to give up legal rights and also control over their trust assets for an overseas count on to properly shield these properties from united state judgments. 6. Choice of a professional and also dependable trustee who will certainly safeguard an offshore count on is much more crucial than choosing an overseas trust fund jurisdiction.

The Basic Principles Of Offshore Trust Services

Each of these nations has count on statutes that are positive for overseas asset defense. There are refined lawful differences amongst overseas count on territories' laws, yet they have extra features in usual.

Authorities data on trust funds are difficult to come by as in many offshore territories (and in a lot of onshore jurisdictions), trust funds are not needed to be registered, nonetheless, it is thought that the most usual usage of offshore trusts is as part of the tax obligation and also monetary preparation of rich people and their households.

The Best Strategy To Use For Offshore Trust Services

In an Irrevocable Offshore Count on may not be transformed or liquidated by the settlor. A makes it possible for the trustee to choose the distribution of earnings for different classes of beneficiaries. In a Set depend on, the distribution of earnings to the recipients is fixed and also can not be altered by trustee.Privacy as well as privacy: Although that an overseas trust is formally signed up in the government, the celebrations of the depend on, properties, as well as the problems of the count on are not videotaped in the register. Tax-exempt condition: Properties that are moved to an overseas trust (in a tax-exempt overseas zone) are not tired either when moved to the trust, or when moved or redistributed to the beneficiaries.

Getting My Offshore Trust Services To Work

This has additionally been done in a number of U.S. states. Rely on general go through the guideline in which supplies (briefly) that where trust building includes the shares of a business, then the trustees have to take a favorable function in the affairs on the firm. The regulation has been criticised, yet continues to be component of trust fund regulation in many common legislation territories.Paradoxically, these specialized types of depends on appear to occasionally be utilized in relationship to here are the findings their original desired uses.

Particular jurisdictions (especially the Cook Islands, yet the Bahamas Has a species of possession defense count on) have provided special depends on which are styled as asset security depends on. While all trusts have an possession defense component, some jurisdictions have passed laws trying to make life tough for creditors to press claims against the count on (for instance, by offering especially short limitation periods). An overseas depend on is a tool utilized for property security and also estate planning that functions by transferring possessions right into the control of a lawful entity based in one more country. Offshore depends on are unalterable, so depend on proprietors can't redeem ownership of transferred properties. They are additionally complicated and costly. Nevertheless, for people with greater liability concerns, offshore trusts can offer security as well as better privacy along with some tax obligation benefits.

The Only Guide to Offshore Trust Services

Being offshore adds a layer of defense and also privacy in addition to the capacity to handle taxes. For example, because the counts on are not located in the United States, they do not have to follow U.S. regulations or the judgments of united state courts. This makes it harder for creditors and also litigants to seek cases versus properties held in overseas depends on.It can be difficult for 3rd parties to determine the possessions and owners of overseas depends on, which makes them help to personal privacy. In order to establish an offshore depend on, the very first action is to pick an international country in which to situate the trusts. Some prominent places include Belize, the Chef Islands, Nevis and also Luxembourg.

The Offshore Trust Services PDFs

Finally, move the possessions that are to be shielded right into the trust. Depend on proprietors might initially develop a limited obligation firm (LLC), transfer assets to the LLC and afterwards move the LLC to the depend on. Offshore counts on can be valuable for estate preparation and also property defense but they have restrictions.people who establish offshore depends on can not leave all tax obligations. Incomes by assets put in an overseas trust are devoid of united state tax obligations. However united state residents who receive circulations as beneficiaries do need to pay U.S. earnings tax obligations on the circulations. United state owners of overseas trusts likewise have to submit reports with the Irs.

The smart Trick of Offshore Trust Services That Nobody is Talking About

Corruption can be a problem in some countries. In enhancement, it is necessary to choose a nation that is not likely to experience political agitation, regime modification, financial turmoil or fast changes to tax plans that might make an offshore count on much less helpful. Lastly, possession security depends on typically have to be established before they are required - offshore trust services.They also do not completely safeguard against all cases as well as might expose proprietors to threats my review here of corruption and political instability in the host countries. Offshore trusts are valuable estate preparation as well as property protection tools. Comprehending the correct time to make use of a specific depend on, and also which trust would supply one of the most benefit, can be complicated.

An Offshore Trust fund is a normal Trust formed under the laws of nil (or low) tax Global Offshore Financial Center. A Depend on is a legal helpful site strategy (similar to an arrangement) whereby one individual (called the "Trustee") in accordance with a subsequent person (called the "Settlor") consents to acknowledge and also hold the home to help different people (called the "Recipients").

Report this wiki page